PCBA EMS & NPI (New Product Introduction)

Acquisition Criteria:

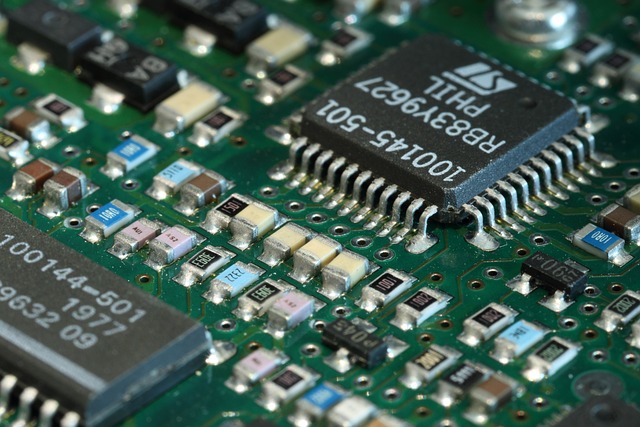

The Buyer – it generates ~$340mm in revenue and ~$50mm in EBITDA – is a North American electronics manufacturing services provider specializing in high-mix, low-volume engineering, design, prototyping, testing, assembly, and lifecycle support services for blue-chip original equipment manufacturers across a range of end markets.

The wanted company is an electronics manufacturing services provider specializing in high-mix, low-volume engineering, design, prototyping, testing, assembly, and lifecycle support services for blue-chip original equipment manufacturers across a range of end markets.

The buyer is looking for a target in the same space. The company preferably has double-digit / mid-teens margins, >$20mm of revenue for PCBA, >$5mm of revenue for NPI (New Product Introduction) with strong revenue synergies, and strong top-customer relationships. The buyer is willing to consider smaller margins for tuck-ins / attractive capabilities.

The preferred end market has minimal to no semiconductor exposure focusing on medicine, other HMLV, and Aerospace & Defence. The geography criteria of the target company are the following: current market tuck-ins, new domestic markets, low-cost nearshore countries, Europe, and Asia, ex. China (e.g. Vietnam, Malaysia). The preferred capabilities of the company are NPI (New Product Introduction) – Interactive process with customers’ R&D engineers to refine product design and optimize manufacturability and testability. A facility offering quick-turn proto-types with one-to-five-day turnarounds -, design/engineering, core EMS capabilities, aftermarket services, and discrete automation.